Table of Content

Most lenders prefer you to borrow no more than 80% of your CLTV, but some will go up to 90%. Home equity loans allow homeowners to borrow against the equity in their homes. Equity is the difference between your home’s value minus what you owe on your mortgage.

As of September 27, the lender had a starting rate of 6.74% for a good-quality borrower, according to a bank representative. This places Fifth Third’s rates in the middle of its peers. Loan terms range from 10 to 30 years, and there are no origination fees or closing costs.

Refinancing into a 15-year mortgage

The Federal Reserve has implemented historic rate hikes in 2022 to combat inflation, and it’s likely these increases will continue for the time being. TD Bank is a great option if you live along the East Coast and prefer to bank in person. With that said, you can also bank by phone, online or via mobile app.

A good way to do this is by taking advantage of prequalification forms, which let you see your potential rates and eligibility with a lender without impacting your credit score. Be sure to confirm this with your lender, however; some prequalifications do in fact involve a hard credit pull, which affects your score slightly. To calculate your home equity, subtract your current mortgage balance from the appraised value of your home.

Calculate your estimated home equity loan rate

Make sure the specific terms of the loan your lender is offering makes sense for your budget. For example, be sure the minimum loan amount isn't too high and don't withdraw more funds than you need. You also want to make sure that your repayment term is long enough for you to comfortably afford the monthly payments. The shorter your loan term, the higher your monthly payments are likely to be. If you have a 30-year mortgage and are more than halfway through your loan term, refinancing into a 15-year loan with a lower rate can save you thousands in interest. While a home equity loan is a "second mortgage" that allows you to borrow additional funds for nearly any purpose, acash-out refinance replaces your existing mortgage.

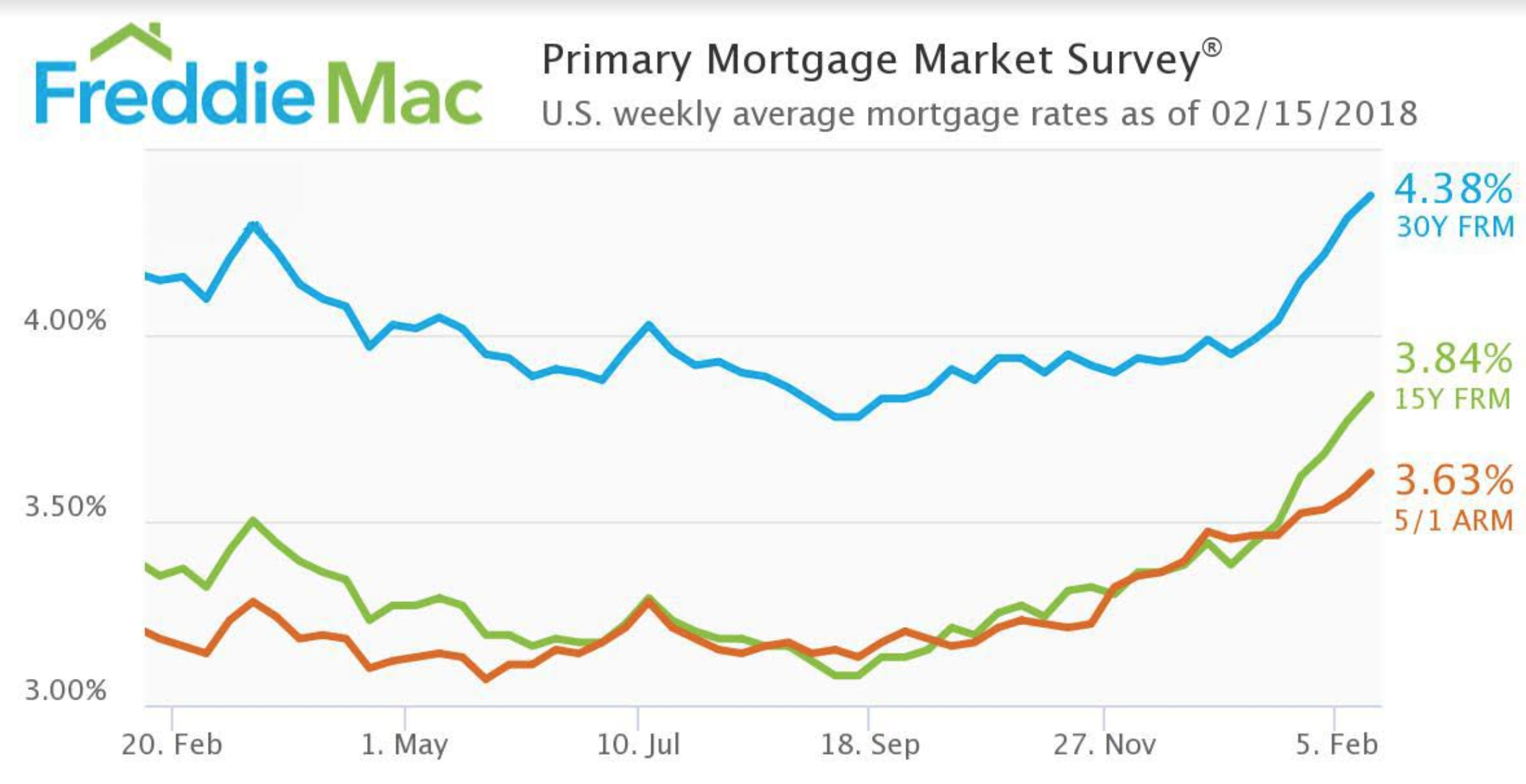

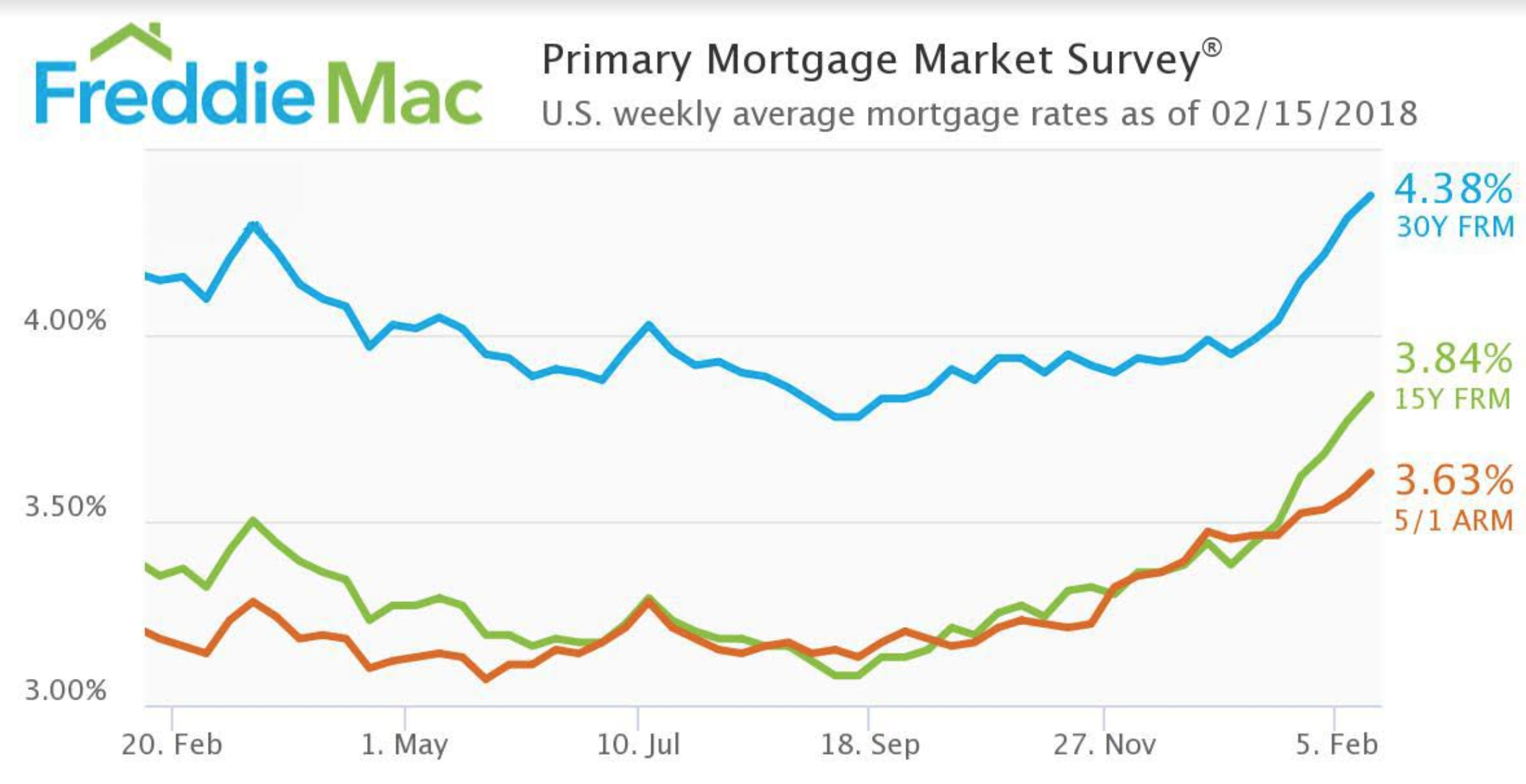

Products, services, terms, and conditions are subject to change without notice. Mortgage interest rates above are for purchase transactions only and include certain point and fee combinations. Rates are subject to change without notice and may vary depending on the loan amount and type of transaction. Interest rates and point combinations for additional loan types are available. Adjustable-rate mortgages, or ARMs, are mortgage loans that come with a floating interest rate.

How to apply for a home equity loan

The two major differences are the way you receive the money and how you pay it back. While a home equity loan is a low interest rate financing option, it's not without risk. When you secure the loan, your home acts as collateral, which means you could lose your home if you're unable to repay what you borrowed. It's important to carefully consider whether a home equity loan is right for you before applying for financing.

The average rate for the benchmark 30-year fixed mortgage is 6.63 percent, unchanged over the last week. Last month on the 13th, the average rate on a 30-year fixed mortgage was higher, at 6.94 percent. Mortgage interest rates were mixed this week, according to data compiled by Bankrate.

If you have used Bankrate.com and have not received the advertised loan terms or otherwise been dissatisfied with your experience with any Advertiser, we want to hear from you. Pleaseclick hereto provide your comments to Bankrate Quality Control. If you are seeking a loan for more than $548,250, lenders in certain locations may be able to provide terms that are different from those shown in the table above. You should confirm your terms with the lender for your requested loan amount. A rough rule of thumb is that the amount of equity you have in your home is the home’s value minus any outstanding loans on the property, like your mortgage. You can use our home equity loan calculator for a more precise calculation.

Typically HELOCs have a variable interest rate that can increase or decrease over time. Generally, there is a fixed "draw" period, during which you may with draw funds, repay them or a portion of them up to a credit limit, similar to a revolving credit card. During the draw period, many lenders permit you to make interest-only payments. After the draw period ends, you can no longer request funds and are required to repay the outstanding balance over the remaining term of the loan. By contrast, a home equity loan gives you all of your funds upfront in a lump sum and usually comes with a fixed interest rate and monthly payment that never change for the life of the loan. Discover offers home equity loans and mortgage refinances instead of HELOCs.

Depending on your lender, you can pay off a HELOC early without being penalized. If you’d like to prepay, try to do it within the interest-only period so you avoid paying more during the repayment time frame. However, some lenders do charge prepayment penalties that could cost up to a few hundred dollars. Many lenders will ask for your Social Security number or other identification, salary, employment information and estimated home value.

Shopping around can help you save thousands over the life of the loan. Bankrate allows you to compare offers from a variety of lenders. On Tuesday, December 13, 2022, the national average 15-year fixed mortgage APR is 6.04%. The average 15-year fixed refinance APR is 6.11%, according to Bankrate's latest survey of the nation's largest mortgage lenders. Is calculated by averaging interest rate information provided by 100-plus lenders nationwide.

You then receive the equity you've already paid off in your home as a cash payout. Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry. She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine.

Depending on the state in which you live, you may also have to pay mortgage taxes and an annual fee. In order to sign up for a Bethpage HELOC, you must become a member of the credit union by opening a minimum $5 share savings account. Additionally, Bethpage HELOCs are not available to borrowers who live in Texas. Interview multiple lenders to determine which lender can offer you the lowest rates and fees.

No comments:

Post a Comment