Table of Content

However, these often come with many fees, and variable interest accrues continuously on the money you receive. Lower lets you borrow up to 95 percent of your home's value, while most other lenders cap LTV at 80 or 85 percent. Now, borrowers with excellent credit and sufficient equity can secure home equity loans with interest rates as low as 5% to 6%, according to Bankrate. For example, if you have a $500,000 mortgage and you owe $350,000 on it, you have $150,000 in equity.

If you know you will pay your loan off quickly - before rates reset - then it may make sense to choose an adjustable rate option. Home equity loans typically have a closing cost ranging between 2% and 5% of the amount borrowed. This would mean that if you borrowed $50,000 you might expect to pay $1,000 to $2,500 in closing costs.

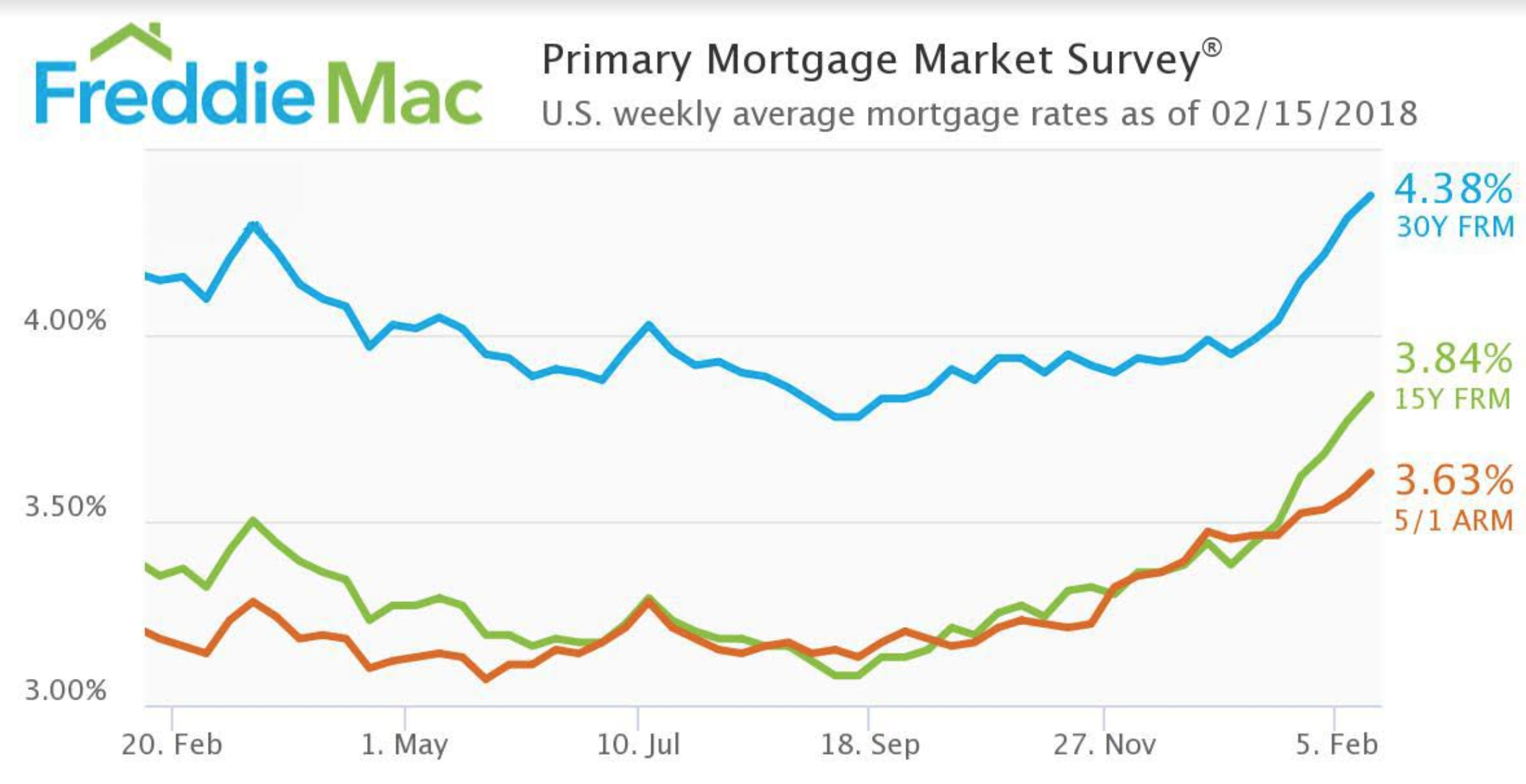

Comparing 15-year fixed and 30-year fixed-rate mortgages

A month ago, the average rate for jumbo mortgages was above that, at 6.90 percent. Monthly payments on a 5/1 ARM at 5.50 percent would cost about $568 for each $100,000 borrowed over the initial five years, but could climb hundreds of dollars higher afterward, depending on the loan's terms. Mobile Home/Manufactured Home loans are available for fixed rates only.

Since you’ll be making fewer payments, you’ll pay less in overall interest. Even if you got the same rate on a 15-year fixed-rate mortgage as you did on the 30-year fixed-rate mortgage, you would still pay less in interest because your payments would end 15 years sooner. Whether you're buying or refinancing, Bankrate often has offers well below the national average to help you finance your home for less. Compare rates here, then click "Next" to get started in finding your personalized quotes. Our advertisers do not compensate us for favorable reviews or recommendations.

HELOC & Home Equity Loan Qualification

Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. For personal advice regarding your financial situation, please consult with a financial advisor. A home equity loan, also called a second mortgage, lets you borrow against the equity you've built up in your home through your down payment, mortgage payments and increased home value. HELOC interest rates tend to be lower than interest rates for home equity loans and personal loans.

To put it another way, the interest rate can change intermittently throughout the life of the loan, unlike fixed-rate mortgages. These types of loans are best for those who expect to sell or refinance before the first or second adjustment. Rates could be considerably higher when the loan first adjusts, and thereafter. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

Does a home equity loan impact your credit score?

The above mortgage loan information is provided to, or obtained by, Bankrate. Some lenders provide their mortgage loan terms to Bankrate for advertising purposes and Bankrate receives compensation from those advertisers (our "Advertisers"). Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria.

Check out Bankrate’s home equity calculator to estimate how much you can borrow. If you're having trouble getting approved, take some time toimprove your credit score. It's also important to decide how a loan could impact your credit score in the future because you'll be taking on more debt with both a home equity loan or a HELOC. When you don’t have a lot of equity in your home, it can be difficult to find a lender willing to extend you credit.

This interest rate table is updated daily to give you the most current rates when choosing a 15-year fixed mortgage loan. The loan terms shown above do not include amounts for taxes or insurance premiums. Your monthly payment amount will be greater if taxes and insurance premiums are included. Home equity loans are often a better option if you know the amount you need already—say for a child’s education or a home construction project. That’s because when you get the money all at once, you repay it according to a fixed interest rate. Starting APRs are based on borrowers having the best credit profiles and applying for an LTV of 80% or less.

The idea is that if you wipe out smaller debt quickly, you’ll have more motivation to tackle larger debt. Not only will you have one less bill to worry about; you’ll own your home free and clear, which can be a mental relief as much as a financial one. You’ll make fewer payments than you would with a conventional 30-year mortgage . Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above.

Discover is well known for its rewards credit cards, but this national bank also offers a full lineup of banking services, such as checking and savings accounts, personal loans and student loans. We chose this bank as the best for low rates because of its national reach (Discover is available in all 50 states and Washington, D.C.) and low rates. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates, get cash out at closing and change your loan term to 5, 10, 15 or 20 years.

BMO’s home equity loans have a higher APR than the national average, but the bank offers a slightly speedier timeline with about 30 days to close. BMO also has a slightly higher CLTV and offers loans as small as $5,000, all of which might put it in the sweet spot for some borrowers. Our ratings take into account interest rates, lender fees, loan types, discounts, accessibility, borrower requirements and other attributes.

If you borrowed $100,000 then buying 1 point would add $1,000 to your loan, while your loan would cost a slightly lower interest rate. Typically each point lowers the interest rate on the loan by 1/8 of a percent. If your home is worth $200,000 and your first mortgage has a balance of $110,000 then the amount due on that mortgage is 55% of the home's value.

The above calculations presume a 20% down payment on a $250,000 home & a closing cost of $3,700 which is rolled into the loan. Interest paid on a HELOC istax deductibleas long as it’s used to “buy, build or substantially improve the taxpayer’s home that secures the loan,”according to the IRS. So if you had a $600,000 mortgage and a $300,000 HELOC for home improvements on a house worth $1.2 million, you could only deduct the interest on the first $750,000 of the $900,000 you borrowed. Lower gets its name from offering "lower" rates and promises a quick approval and closing process. The application process is completely online, and the application is streamlined and full of easy-to-understand language.

Loan Payment Example

This would mean that if a lender has a max LTV of 80% a borrower could borrow up to an additional 25% of the value of the home ($50,000) via either a home equity loan or a home equity line of credit. Compare 15-Year Home Equity Loan rates from lenders in New Jersey with a loan amount of $ 50,000. To change the mortgage product or the loan amount, use the search box above. A HELOC is not a good idea if you don't have a steady income or a financial plan to pay off the loan.

No comments:

Post a Comment